Balance Sheet Automation Tool

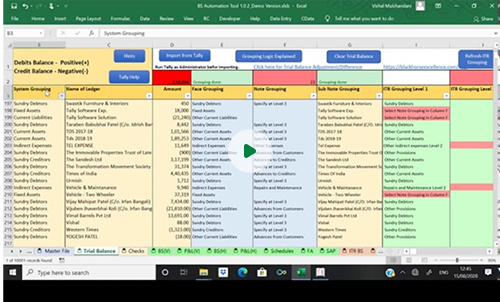

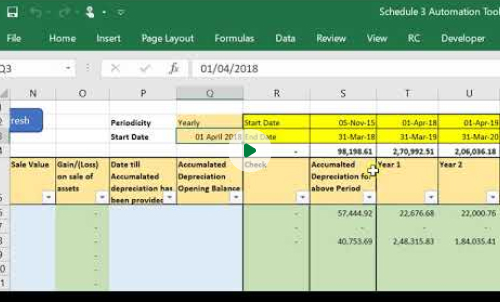

The Balance Sheet Automation Tool is an advanced Excel-based solution designed to instantly prepare Balance Sheet, Profit & Loss Account, Trading/Manufacturing Account, and Schedules with just a few clicks.

Fully integrated with Tally ERP 9/Tally Prime, it eliminates repetitive manual work by directly generating reports and financial statements.

The tool also supports seamless integration with CompuTax, Winman, and Spectrum for ITR 3 and ITR 5 formats, ensuring smooth filing and compliance.

Updated as per the latest ICAI Guidance Note (August 2023) for non-corporate entities and LLPs, it delivers accuracy, compliance, and consistency.

By automating grouping, formatting, and consolidation, the tool standardises financials across multiple branches or companies, while minimizing errors and rework. With built-in themes, preventive controls, and columnar reporting, firms can present polished, audit-ready financials quickly and reliably — saving valuable hours for analysis and client service instead of formatting.

Why Thousands of CAs Trust Black Horse

End-to-End Automation

Eliminates manual work by preparing Balance Sheet, P&L, and Schedules directly from Tally with just a few clicks.

Tax Filing Made Easy

Seamless integration with CompuTax, Winman, and Spectrum ensures smooth ITR 3 & 5 filing.

Regulatory Compliance

Updated as per ICAI’s August 2023 Guidance Note, keeping reports accurate and compliant for LLPs and non-corporate entities.

Branch Consolidation

Consolidates accounts from multiple branches or tally companies into a single, error-free report.

Structured Reporting

Generates columnar Balance Sheets, P&L, and elimination reports for clear, professional presentation.

Time Savings

Auto-grouping and auto page setup minimise repetitive formatting, saving valuable hours.

Consistent Output

Uniform formats and built-in themes ensure polished, standardised financials across all clients.

Error Reduction

Automation reduces risks of formula mistakes and manual inconsistencies, improving accuracy.

Why Thousands of CAs Trust Black Horse

Seamless Integration

Prepare ITR 3 & 5 Balance Sheet, Profit & Loss, and Trading/Manufacturing Accounts, with direct integration to CompuTax, Winman, and Spectrum.

Branch Consolidation

Consolidate accounts across multiple branches or companies effortlessly, ensuring accuracy and consistency.

Columnar & Professional Reporting

Generate columnar Balance Sheets, P&L, and elimination reports for clear and structured financial presentations.

Automated Formatting

Save time with auto-grouping, auto-page setup, and customizable themes that deliver polished, professional outputs instantly.