Schedule 3 Automation Tool

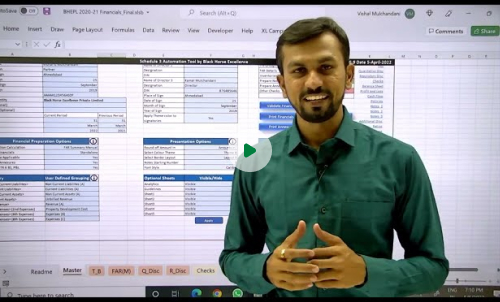

Schedule 3 Automation Tool is built to simplify the preparation of financial statements for Private and Limited Companies in line with Schedule 3 of the Companies Act, 2013 (Division I – Non-Ind AS format).

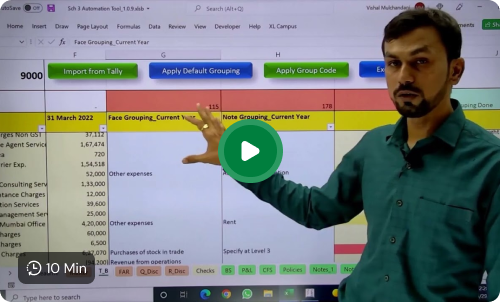

Integrated with Tally ERP/Tally Prime and compatible with Excel trial balances, it automates much of the grouping, formatting, and disclosure requirements that usually consume hours of manual effort.

With in-built compliance to the latest MCA amendments, preventive controls, and professional presentation layouts, the tool ensures accuracy and consistency in every report.

By removing repetitive formatting and minimising manual adjustments, the tool helps firms deliver standardised, audit-ready financials without the stress of errors or rework.

Over time, it saves significant hours, streamlines collaboration across teams, and enables professionals to shift their focus from formatting and data entry to analysis, strategy, and client service.

Why Thousands of CAs Trust Black Horse

Standardized Format

Every company’s financials follow a uniform structure, eliminating inconsistencies across clients.

Single Integrated File

Manage financials, depreciation, fixed assets, cash flow, and annexures all in one streamlined file.

Significant Time Savings

From the second year onward, repetitive work is minimised, saving countless resource hours.

Minimal Manual Effort

Automated page setup, formatting, and editing free up time for analysis and strategic work.

Professional Presentation

Choose from theme-based financials that resemble listed company reports for a polished look.

Tally Integration

Seamlessly import trial balances from Tally ERP/Tally Prime with just a click.

Multi-Branch Capability

Import and consolidate multiple trial balances from different branches or companies with ease.

Ready Annexures

Generate department-ready annexures instantly, ensuring smooth scrutiny and compliance.

Why Thousands of CAs Trust Black Horse

Seamless Integration

Import trial balances directly from Tally ERP/Tally Prime or Excel files from any accounting software.

Comprehensive Compliance

Covers all Schedule 3 MCA amendments, regulatory disclosures, depreciation as per Companies Act, and cash flow statements.

Automated Grouping & Formatting

50–70% auto-grouping with built-in rounding, disclosures, and page setup, cutting down hours of manual work.

Consolidation Made Easy

Consolidate accounts of up to 25 companies/branches with columnar Balance Sheets, P&L, and elimination reports.

| Features | General Excel File | Software | Schedule 3 Automation Tool |

|---|---|---|---|

| Standard Format | ❌ | ✔️ | ✔️ |

| Import From Tally ERP | ❌ | ✔️ | ✔️ |

| Auto–Grouping | ❌ | Manual | ✔️ |

| Perpetual Depreciation Calculator | ❌ | ❌ | ✔️ |

| High Level Of Automation | Depends On User | Moderate | Very High |

| Chance Of Formula Errors | Very High | NA | Minimum |

| Checks Sheet | Manual | ❌ | ✔️ |

| Auto Page–Setup | ❌ | ❌ | ✔️ |

| Auto Headers | Manual | ✔️ | ✔️ |

| Change Font | Manual | ❌ | ✔️ |

| Themes | ❌ | ❌ | ✔️ |

| Cash Flow | Manual | Manual | ✔️ |

| User-Friendly | NA | ❌ | ✔️ |

| Round Off Adjustment | Manual | ❌ | ✔️ |

| Time Spent | Time Consuming Every Year | NA | Huge Time Saving From 2nd Year Onwards |

| For Consolidation | |||

| Branch/Company Consolidation | ❌ | ✔️ | ✔️ |

| Import Multiple Tally Company | ❌ | ✔️ | ✔️ |

| Consolidation | ❌ | ✔️ | ✔️ |

| Branch Wise Columnar Financial | ❌ | ✔️ | ✔️ |

| Elimination Report | ❌ | ✔️ | ✔️ |

Sample-FS_Schedule-3-Tool-for-Companies

Why Thousands of CAs Trust Black Horse

Frequently Ask Questions

Yes, there is an add on tool, Ageing Automation Tool to prepare Ageing of Debtors and Creditors as per the requirements of Schedule III. This prepares ageing on FIFO basis, hence even if in Tally accounting entries are not done on Bill to Bill basis, this tool prepares ageing for those cases as well.